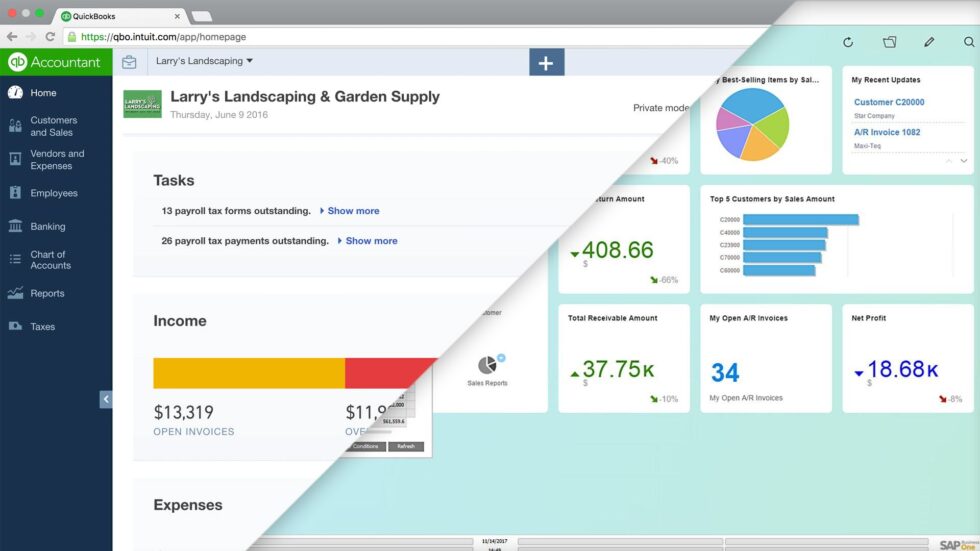

What is Quickbooks

Let’s start by knowing Quickbooks,

Quickbooks is a wildly popular financial management software. In 2015 they had 80% of the market share with 29 million small businesses in the US, and QuickBooks is still growing strong.

They have currently over 2.2 million subscribers for QuickBooks online, a very big number of which is Self-Employed users. Those users are a very strong focus of Quickbooks in their overall strategy, but specifically for Singapore. Recently Intuit launched QuickBooks Self-Employed, a way for the Singaporean self-employed community to stay on top of business expenses. There also is a mobile app aims to ease accounting tasks for the Singapore Self-Employed users.

Is it time to upgrade from QuickBooks?

The truth is that change is difficult. If things (more or less) work, then people are very resistant to change. Pure accounting software provides you with significantly more flexibility to adjust business processes on the fly – and this is a double-sided sword. If a process can change depending on your customer, your internal staff, the whims and fancy of your people, then there is no consistency. This prohibits profitable growth and clear transparency on the business. The more a company grows, the more excel spreadsheets you will need to keep a tab on all the activities and to create the reports you need to run the company.

How do you know whether your company has grown to a stage that you may want to consider upgrading from Quickbooks to an ERP system?

Here are some of the signs to look out for:

1. The quantity of spreadsheets utilized in your association begins to develop (like, truly develop). At the point when individuals begin to ensure their valuable spreadsheets like their (corporate) life relies upon it, you know it’s the ideal opportunity for a change.

2. Answers for (as far as anyone knows) basic inquiries, (for example, “What is my normal income for the following 3 months?” abruptly take any longer like they used to.

3. It appears to take a decade to close the books and give exact Balance sheets and profit and loss reports. (Since account reconciliation for month-end become troublesome).

4. You extended your business into another region, perhaps work under various time zones. Your group won’t have the option to get to ongoing information and subsequently keep on depending on mystery rather than up-to-date data.

5. You need automation and coordination of your bookkeeping program with different frameworks. Sadly, there are constraints to the capacity of Quickbooks to coordinate with 3rd party programming. So to manage a different CRM framework, and a few spreadsheets to oversee data, you should manually consolidate this data – and you might not have any desire to do that.

6. You need to be GAAP compliant, which expects you to have review trails on every single monetary transaction. Quickbooks permits you to transform anything without a review trail – this could turn into an issue not far off.

Quickbooks is extremely incredible programming for Freelancers, Self-Employed clients, and entrepreneurs. It is economical, adaptable and can carry out the responsibility while your business is small.

However, when your business has grown and you have more than one individual running your records, when you have stock, conveyance, and CRM needs, you should consider an ERP solution that scales with your organization. All things considered, you burn through a ton of energy to develop your organization to the size that it is presently, and you wouldn’t need your IT condition to keep you away from further development.

We have helped numerous organizations to move from Quickbooks to SAP Business One for precisely those reasons. To discover more about SAP Business One and how it can assist your association with increasing profitability, We can help you.

Recent Comments